据分析师Mullooly预测,物联网在未来数年内附加服务获得的产值比接驳费更高。预计非连通性M2M(机器对机器)服务附加值会从2013年的21%上升至2016年的53%,提高将近一半。

移动网络运营商( MNO )一直在努力应对消费者零售业务领域连接服务收入减少所带来的的威胁,由于竞争加剧,同样的趋势也开始在M2M领域浮出水面。运营商也在拉长M2M价值链并且提供端至端( E2E )解决方案对抗这种趋势。

Mullooly表示,通过物联网这个生态圈,数十亿的轿车,电表,电视,甚至家具都可以使用互联网发送他们的状况和状态,而运营商需要知道它们将在这个生态系统扮演什么样的角色。

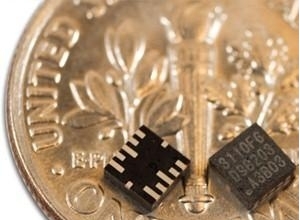

许多垂直和行业采用M2M技术连接许多不同的设备和机器。因此, M2M已取得显著效果作为移动网络运营商一种新的业务领域。运营商完全可以提供维护模块和传感器之间的联系服务,并推动业务转型为他们的客户,但M2M连接,行业正在走向成熟需要近无处不在的连接。当采购的M2M解决方案的企业有只有几个选择,但越来越多的移动运营商正在推出服务占领这个市场。比赛进行连接,也从专用的M2M虚拟网络运营商,卫星连接提供者和其他连接服务提供商使用专用的,非蜂窝频谱到来。

随着竞争的加剧,与连接相关联的利润率将受到挤压。新的M2M采用3G和4G网络,并产生高数据使用量,如视频监控,或连接汽车服务,新的M2M应用的激增可能会抵消连通性收入下降。然而,移动网络运营商将面临保持竞争力的挑战,而M2M连接,正在成为商品化和连接利润率威胁带来的停滞或萎缩,说Mullooly 。

大多数运营商已经认识到这一点,并正在向价值链所提供的M2M解决方案,通过提供与合作伙伴的硬件或软件连接起来的M2M解决方案来向上发展价值链,根据最近的观梅森调查的结果。

10家全球领先运营商表示,他们预计非连接的服务,占据超过每个连接(到在M2M业务上2016年超过ARPC一半 ),连接预计将保持M2M收入的最大的单一组成部分,因为它是移动运营商“ M2M业务的基石,但其份额将在2013年第三季度从79%跌落到2016年第三季度下降47%, 。

运营商从单纯的连接提供商到到端到端的M2M解决方案提供商转型是这种演变背后的主要驱动力之一,并主要基于云服务。许多运营商已经组建了端到端产品组合,使他们产生更多的增值服务收入。他们将继续开发新的合作,并推出新的战略合作伙伴关系的模型包括与应用开发商和系统集成商,这往往是为提供端到端业务的重要合作伙伴。

以下为外文:

The Internet of Things is said to rake in more revenue from additional services than connection fees in the course of the next few years. This is expected to generate an increase in the proportion of non-connectivity M2M fees by over half, from 21 per cent in 2013 to 53 per cent in 2016, according to Analysys Mason analyst Mullooly.

While mobile network operators (MNO) have been struggling against the threat of decreasing connectivity revenue on the consumer retail side of their business, the same trend is also beginning to surface in the M2M sector as it matures and competition intensifies. Operators are moving up the M2M value chain and delivering end-to-end (E2E) solutions, rather than just simple connectivity, in an effort to combat this trend.

With billions of things cars, utility meters, TVs and even furniture linked via the Internet and sending information about their status and condition, operators need to determine what role they will play in this ecosystem, noted Mullooly.

Many verticals and industries are adopting M2M technology to connect many different devices and machines. As a result, M2M has gained significant traction as a new business area for MNOs. Operators are well placed to provide the near-ubiquitous connectivity needed to maintain links between modules and sensors and to help drive business transformation for their clients but the M2M connectivity sector is maturing. Enterprises have had only a few choices when procuring an M2M solution, but more and more MNOs are launching services for this market. Competition for connectivity is also coming from dedicated M2M MVNOs, satellite connectivity providers and other connectivity service providers using dedicated, non-cellular spectrum.

The margins associated with connectivity will be squeezed as competition increases. The proliferation of new M2M applications that use 3G and 4G networks and generate high data usage, such as video surveillance or connected car services, could offset declines in connectivity revenue. Nevertheless, MNOs will face the challenge of remaining competitive while M2M connectivity is becoming commoditized and connectivity margins threaten to stagnate or shrink, said Mullooly.

Most operators have recognised this, and are moving up the value chain by offering M2M solutions that combine connectivity with partners" hardware or software, according to the results of a recent Analysys Mason survey.

Ten leading global operators indicated that they expect non-connectivity services to account for more than half of the average revenue per connection (ARPC) from M2M services by 2016. Connectivity is expected to remain the largest single component of M2M revenue because it is the cornerstone of MNOs" M2M businesses, but its share will decline from an average of 79 per cent in 3Q 2013 to just 47 per cent in 3Q 2016.

Operators" transition from pure connectivity providers to E2E M2M solution providers is one of the primary drivers behind this evolution and is based largely on cloud services. Many operators have assembled E2E product portfolios that will enable them to generate more value-added-services revenue. They will continue to develop new collaborations and launch new strategic partnerships models including those with application developers and systems integrators, which are often essential partners for delivering E2E services